Highspot for banking

Earn trust through compliant execution

Help bankers deliver compliant, high-value experiences that drive growth at every customer touchpoint.

Power performance across financial services teams

Financial institutions face relentless pressure to meet rising client expectations, navigate complex regulations, and outperform growing competition. With Highspot’s unified GTM platform, client-facing teams are empowered to deliver personalized, compliant, and impactful experiences across every product line, channel, and interaction.

Commercial banking

Empower relationship managers with compliant, high-impact materials tailored to complex client needs, whether onboarding a mid-market firm or managing a syndicated loan.

Retail banking

Deliver consistent, trusted client engagement: from mortgage consultations, to everyday banking. Highspot helps teams surface timely guidance and resources within their flow of work.

Lending and mortgage operations

Speed loan cycles and improve accuracy with governed content, AutoDocs for loan docs, and training tied to regulation.

Investment banking

Equip deal teams with real-time access to the latest materials, talking points, and training for fast-moving pitches and market shifts.

Transform how client facing teams work

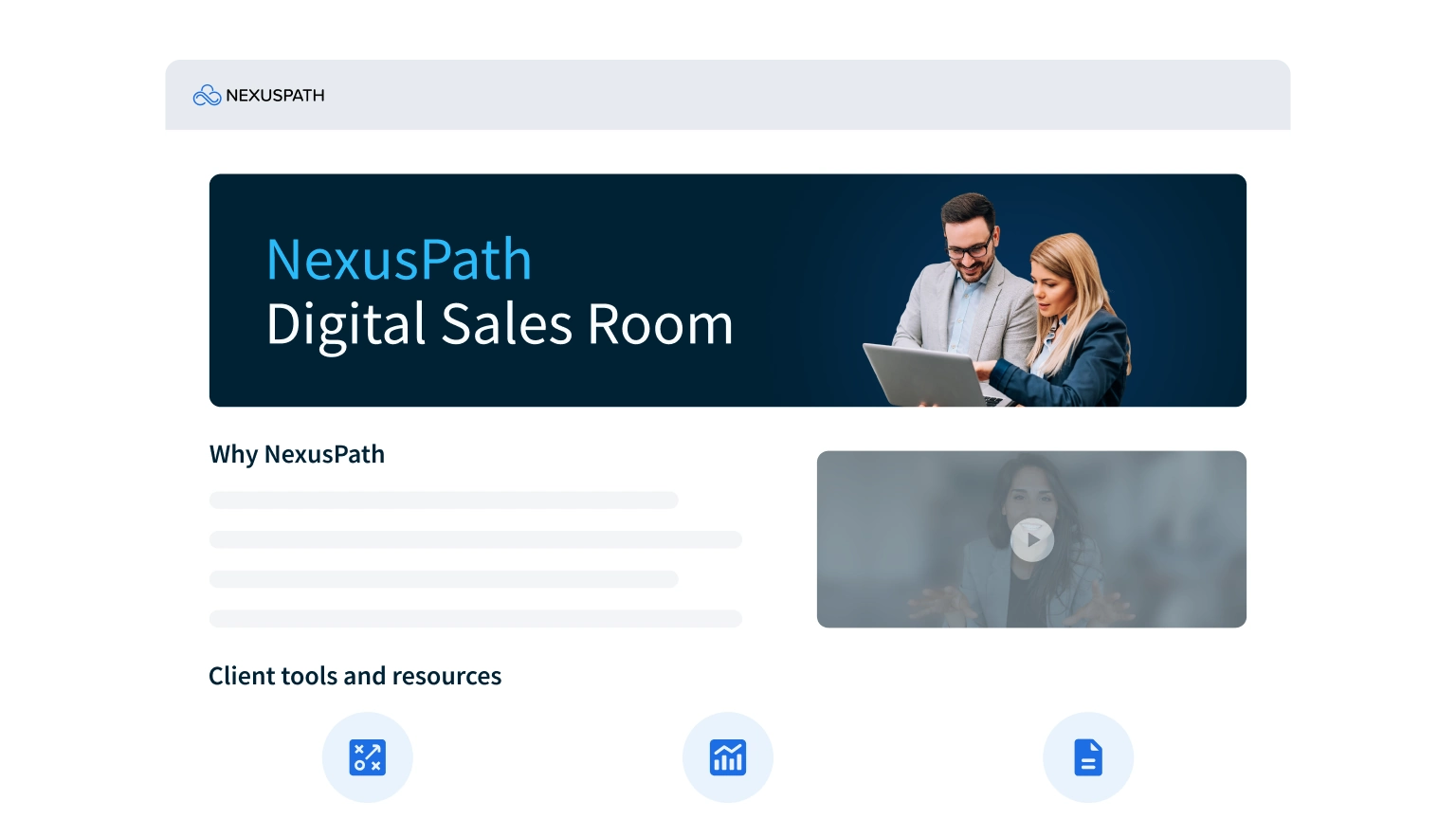

Personalization at scale

Create compliant, client-specific Digital Sales Rooms featuring approved materials, proposals, and policy details tracked end-to-end.

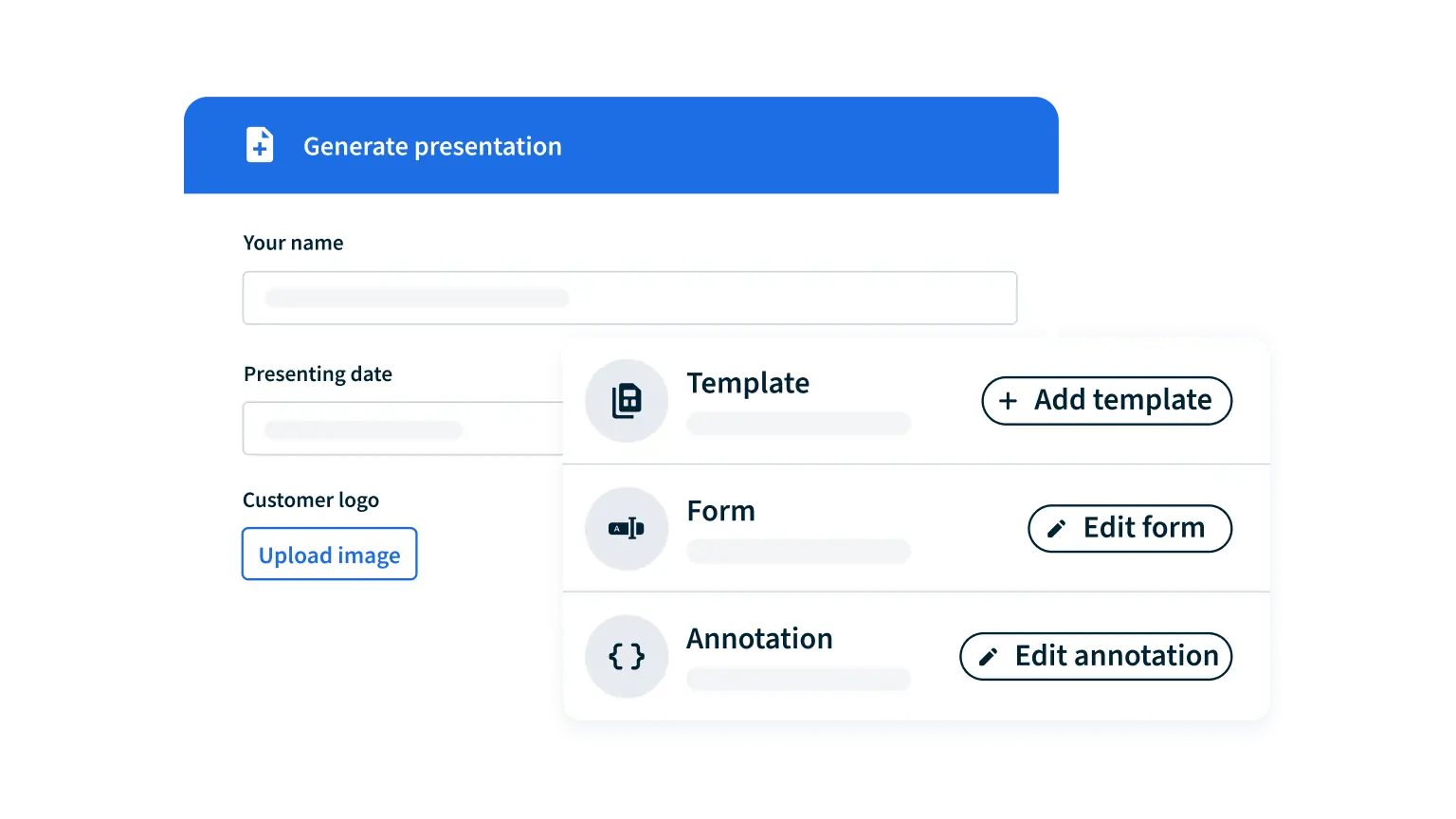

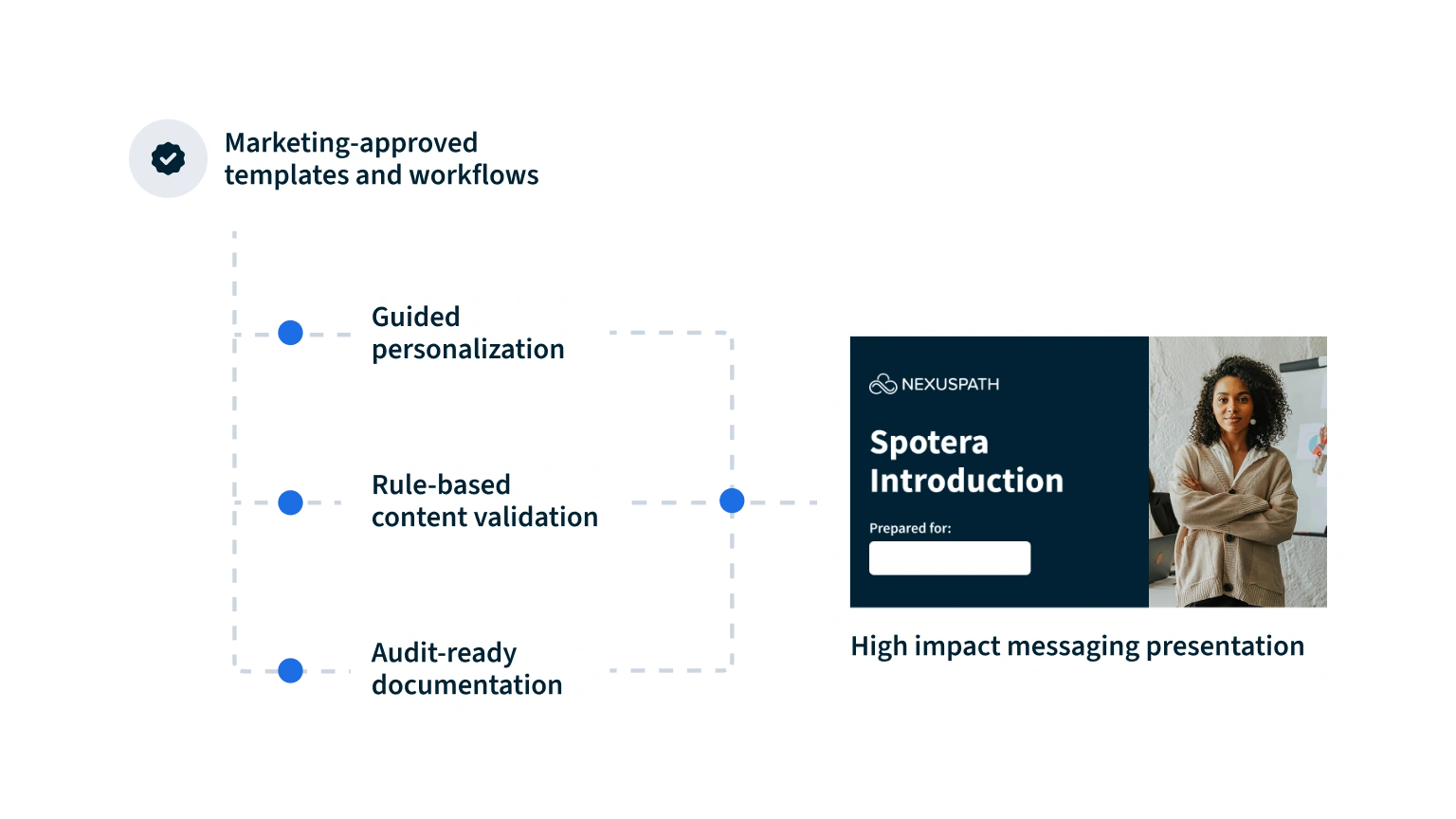

Document automation

Generate client-ready policies from approved templates with AutoDocs. Merge data, lock brand/disclosures, and cut prep time without risking compliance.

Guidance, training, and coaching in the flow of work

Embed Highspot in Salesforce, Dynamics, and Outlook to guide every step. Agents surface the right content, plays, and next steps; managers reinforce skills with AI feedback.

Safe, compliant AI for banking and lending

AI to guide teams and protect your brand

Surface only approved, role-specific recommendations, keeping bankers and relationship managers compliant while moving deals forward.

Enterprise grade security for regulated industries

Meet global financial standards with secure, natively built infrastructure, so customer data stays protected at every touchpoint.

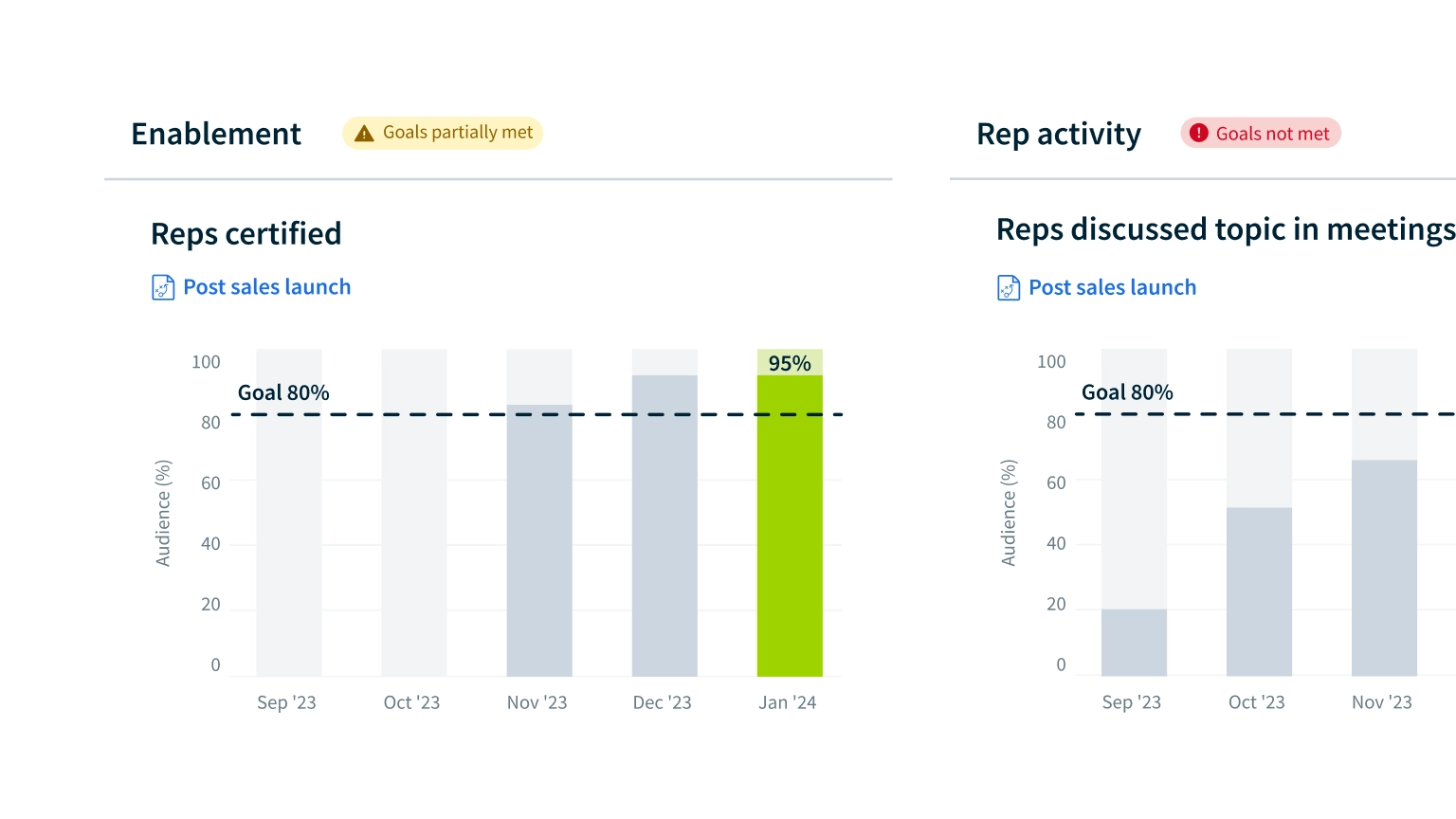

Identify and scale what works

Performance scorecards for every banker

Track readiness, skills, and performance by individual, team, and channel to see who’s on track and where to focus coaching.

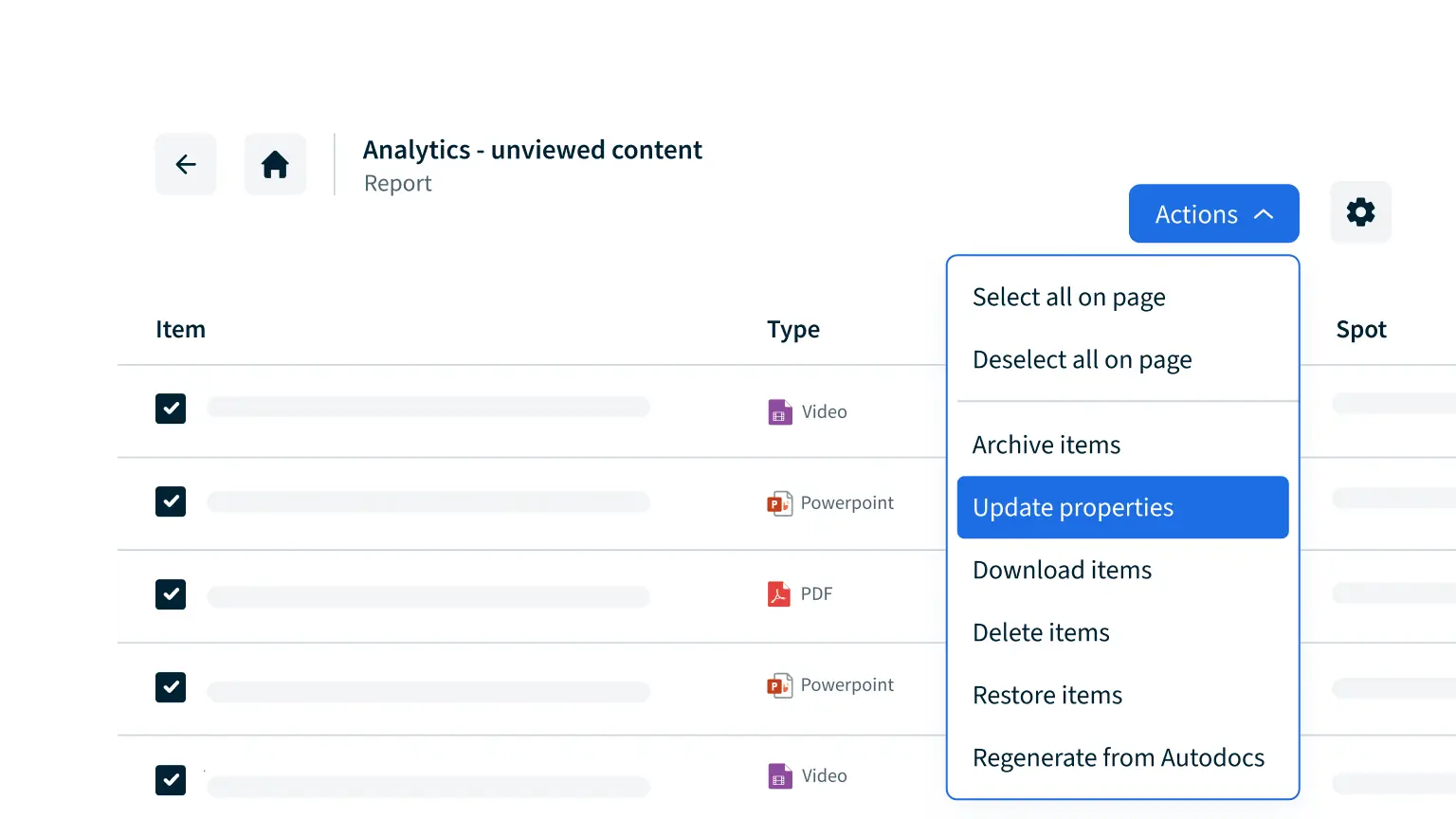

Closed-loop content governance

Archive or update outdated materials directly from analytics dashboards, ensuring only compliant, current content reaches clients.

A high-performing go-to-market team starts here

Award-winning artificial intelligence

Agentic AI that acts with insight so every move makes an impact. Whether it’s moving a deal forward, scaling an initiative, or turning around a quarter, agentic AI helps GTM teams rise to the moment with clarity, confidence, and impact.

Actionable analytics

Turn every GTM signal into performance-driving insights. Track adoption, behavior change, and outcomes with unified analytics across content, training, coaching, and engagement to understand business impact and optimize your GTM strategy.

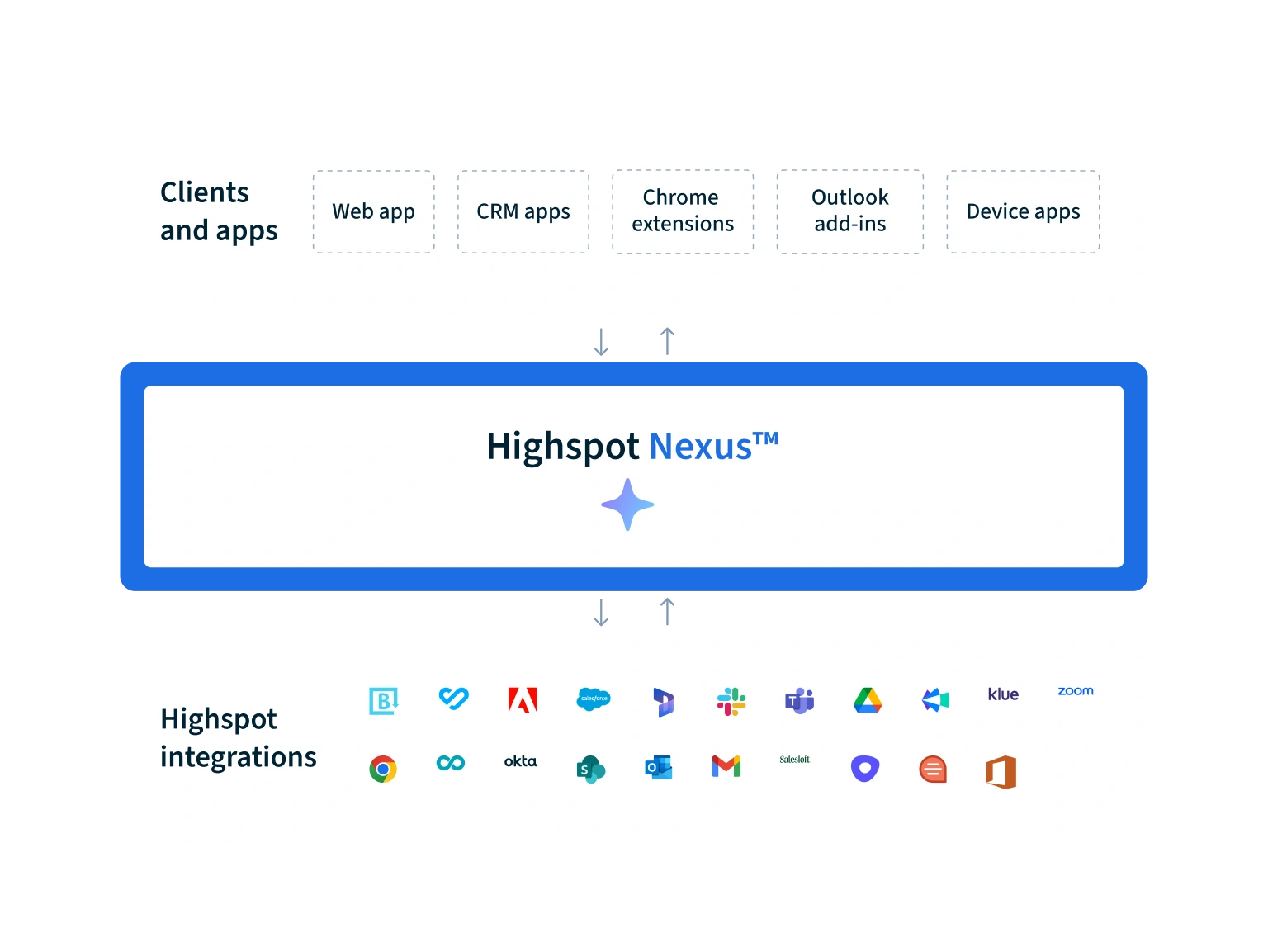

Industry-leading ecosystem

AI-powered execution embedded in every GTM workflow. Highspot connects with your GTM stack—Salesforce, Outlook, Slack, and more—embedding AI-powered guidance in daily workflows and enhancing the impact of your existing AI tools.

Enterprise security and compliance

Enterprise-grade security built for AI-powered go-to-market. Highspot safeguards your content and data with encrypted AI inference, role-based access, global compliance support, and a commitment to never using customer data to train models.

Conversation intelligence

Go beyond call transcripts. Measure, coach, and grow skills that drive performance. Highspot connects practice and real-world performance using a skill framework to evaluate calls, training, and Role Play, then deliver targeted feedback that drives growth.

Recommended content